Lab Analysis: Indian IT's AI Gambit - Leadership Battle in a Shifting Landscape

A data-driven deep dive into margins, growth momentum, and the real AI revenue story

"In the business world, the rearview mirror is always clearer than the windshield."

— Warren BuffettDisclaimer: This post is for educational purposes only. It is not investment advice or a recommendation to buy or sell any securities. I am not a SEBI-registered investment advisor. Please consult your RIA before putting in your hard-earned money.

Today is February 8th, and if you’re holding Indian IT stocks, you’ve likely watched your portfolio navigate choppy waters. But here’s what most investors miss: while everyone’s focused on quarterly revenue growth, a fundamental shift is happening beneath the surface.

AI isn’t just a buzzword anymore. It’s becoming a revenue line item.

In this piece, we’ll dissect:

The Growth Divergence - Why HCLTech is outpacing peers

The Margin Story - Who’s protecting profitability in the AI transition

The AI Revenue Reality - Separating hype from actual dollars

So grab your coffee, and let’s decode what the numbers are really telling us.

The Growth Divergence: Not All IT is Created Equal

Let’s start with what matters most: growth momentum.

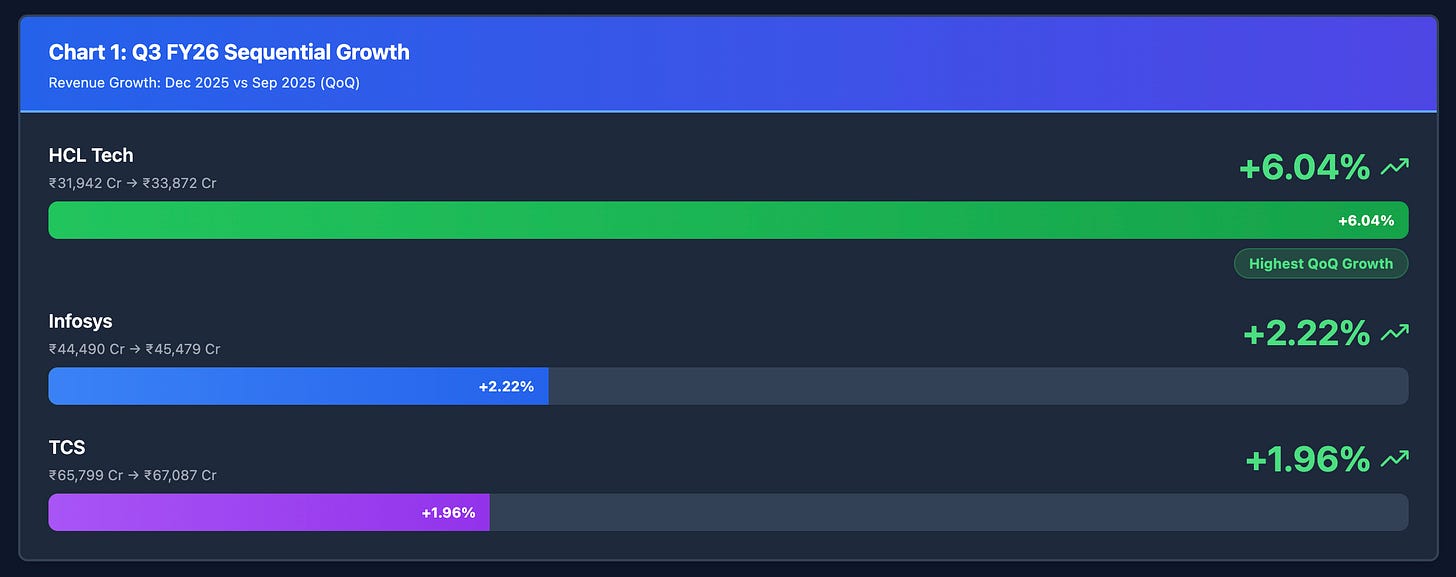

Chart 1: Q3 FY26 Sequential Growt

Chart 2: Year-on-Year Growth Comparison

Here’s what jumps out:

HCLTech is running a different race. While TCS and Infosys crawled forward, HCLTech sprinted ahead at 6.04% QoQ. That’s 3-4x faster than its peers.

But before you rush to conclusions, let’s understand why.

The Tale of Three Strategies

TCS: The infrastructure play. They’re building AI data centres ($1B partnership with TPG) and betting on becoming the “world’s largest AI-led technology services company.” Think: picks and shovels in a gold rush.

Infosys: The partnership play. They’re integrating with AI-native companies (Cognition’s Devin agent) and building six AI value pools. Think: aggregator model.

HCLTech: The “Day-1” services play. They’re capturing revenue from Physical AI, AI factories, and custom silicon engineering - the infrastructure enabling AI before enterprises even deploy it. Think: selling to the sellers.

💡 Quick Insight: Growth divergence isn’t random. It reflects strategic positioning. HCLTech is monetising the preparation for AI, while others are monetising AI adoption itself.

Which strategy do you think will compound better over 3-5 years? Drop a comment below.

The Margin Fortress: Who’s Protecting Profitability?

Revenue growth without margin discipline is just buying revenue. Let’s see who’s actually creating shareholder value.

Chart 3: Operating Margin Comparison (Adjusted for One-offs)

HCLTech’s margin story is the most interesting. They expanded 111 bps QoQ despite restructuring costs. Strip out the one-offs, and they’re at 19.4% - just 13 bps below last year. That’s margin resilience while growing 4.2% sequentially.

The Margin Math

Let’s do some lemonade stand economics:

Company A (TCS): Makes ₹25.20 profit on every ₹100 of revenue

Company B (Infosys): Makes ₹21.20 profit on every ₹100 of revenue

Company C (HCLTech): Makes ₹18.60 profit on every ₹100 of revenue

Now, if all three grow revenue by 10%, who creates more absolute profit?

Company A: ₹25.20 → ₹27.72 (+₹2.52)

Company B: ₹21.20 → ₹23.32 (+₹2.12)

Company C: ₹18.60 → ₹20.46 (+₹1.86)

TCS generates 35% more profit than HCLTech on the same revenue growth.

But here’s the flip side:

If HCLTech grows at 4.2% while TCS grows at 0.8%, the math changes:

TCS: ₹25.20 → ₹25.40 (+₹0.20)

HCLTech: ₹18.60 → ₹19.38 (+₹0.78)

Suddenly, HCLTech creates 4x more incremental profit despite lower margins.

The lesson? Growth can offset margin disadvantage. Margin can offset growth disadvantage. You need to understand which game each company is playing.

The AI Revenue Reality: Hype vs. Hard Numbers

Everyone’s talking AI. But who’s actually monetising it?

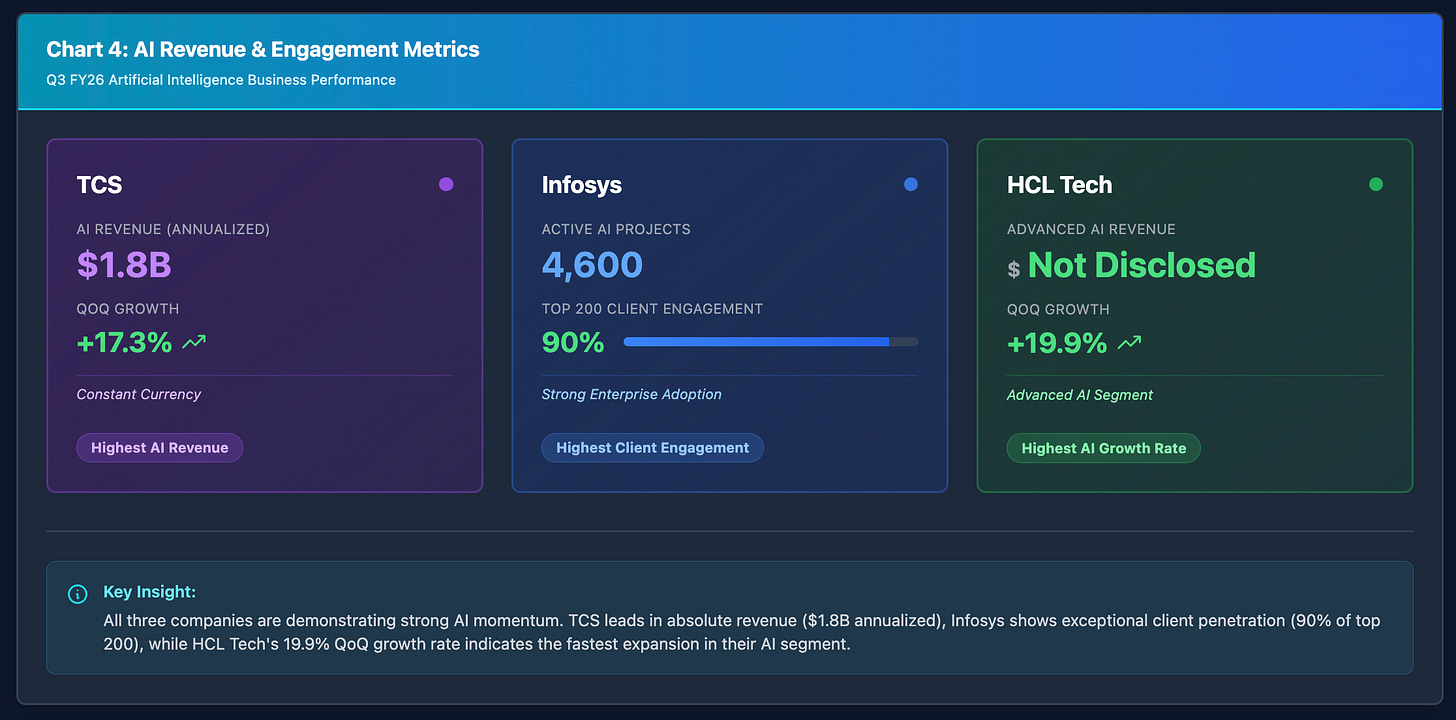

Chart 4: AI Revenue Snapshot

TCS wins on disclosure. $1.8B annualized AI revenue growing at 17.3% QoQ is concrete.

Infosys wins on penetration. Working with 90% of their top 200 clients on AI means ecosystem lock-in. They’re becoming embedded in enterprise AI transformation.

HCLTech wins on differentiation. Their focus on Physical AI, AI factories, and custom silicon isn’t competing with TCS/Infosys. They’re in adjacent white spaces.

The Three Waves of AI Revenue

Think of AI monetisation in three waves:

Wave 1: Preparation (2023-2024)

Data migration, cloud readiness, infrastructure setup. This is what HCLTech calls “Day-1” services. Margins are decent, deal sizes are large.

Wave 2: Implementation (2024-2025)

Building AI agents, deploying GenAI use cases, legacy modernisation. This is where all three are competing. Margins compress slightly due to productivity sharing.

Wave 3: Operations (2026+)

Managing AI estates, continuous optimisation, AI-as-a-service. This is steady annuity revenue with good margins.

The insight: TCS and HCLTech are already in Wave 2 with revenue traction. Infosys is building infrastructure for all three waves simultaneously through partnerships.

Question for you: Which wave do you think offers the best risk-adjusted returns for IT companies?

The Large Deal Engine: Who’s Winning the Pipeline?

Revenue is a lagging indicator. Deal wins are a leading indicator.

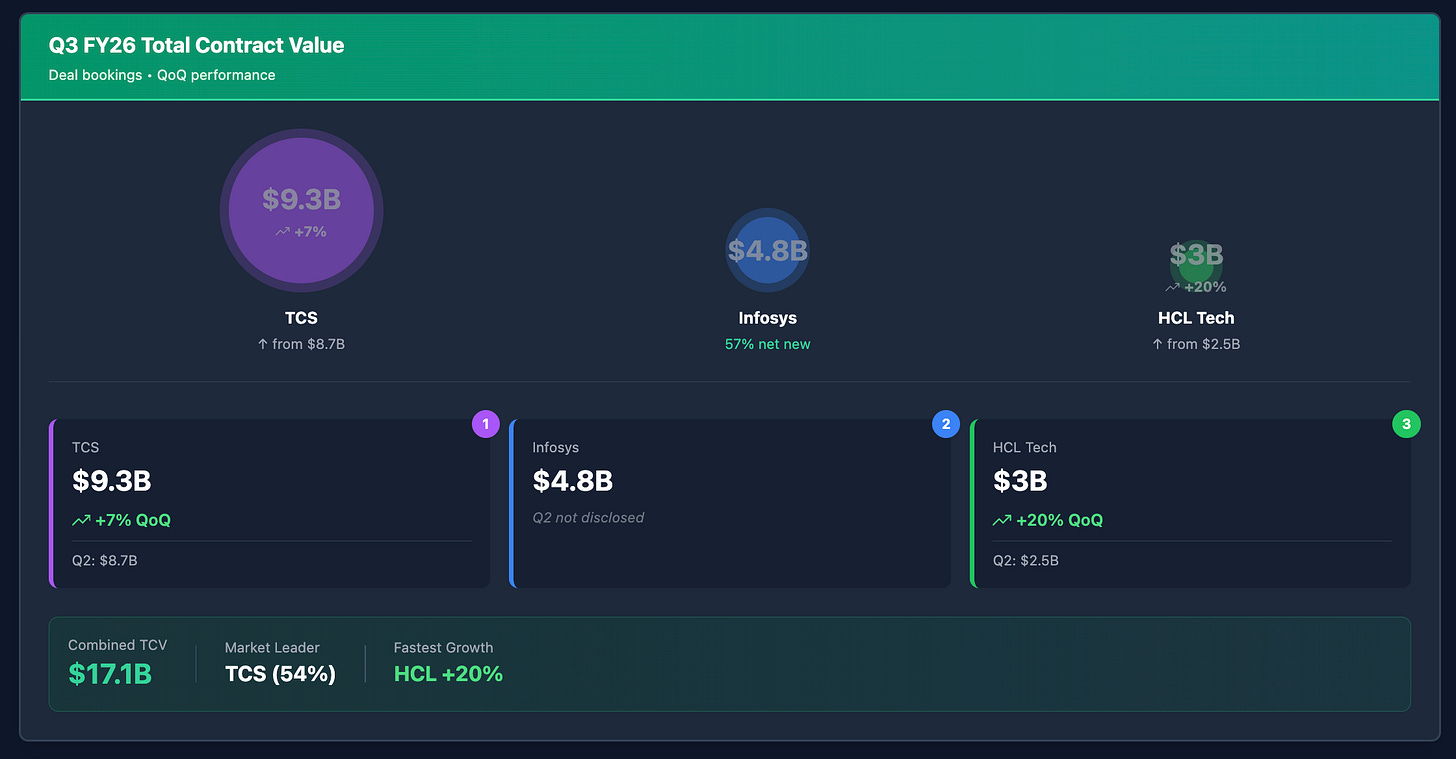

Chart 5: Q3 FY26 Total Contract Value (TCV)

TCS dominates absolute deal volume. $9.3B in one quarter is exceptional. That’s conversion fuel for the next 2-3 quarters.

But look at the velocity:

HCLTech: +20% QoQ deal momentum

TCS: +7% QoQ deal momentum

Infosys: Strong net-new component (57%)

The pattern: All three are winning. But they're winning different types of work, which will flow through to revenue at different rates

The BFSI Comeback Story

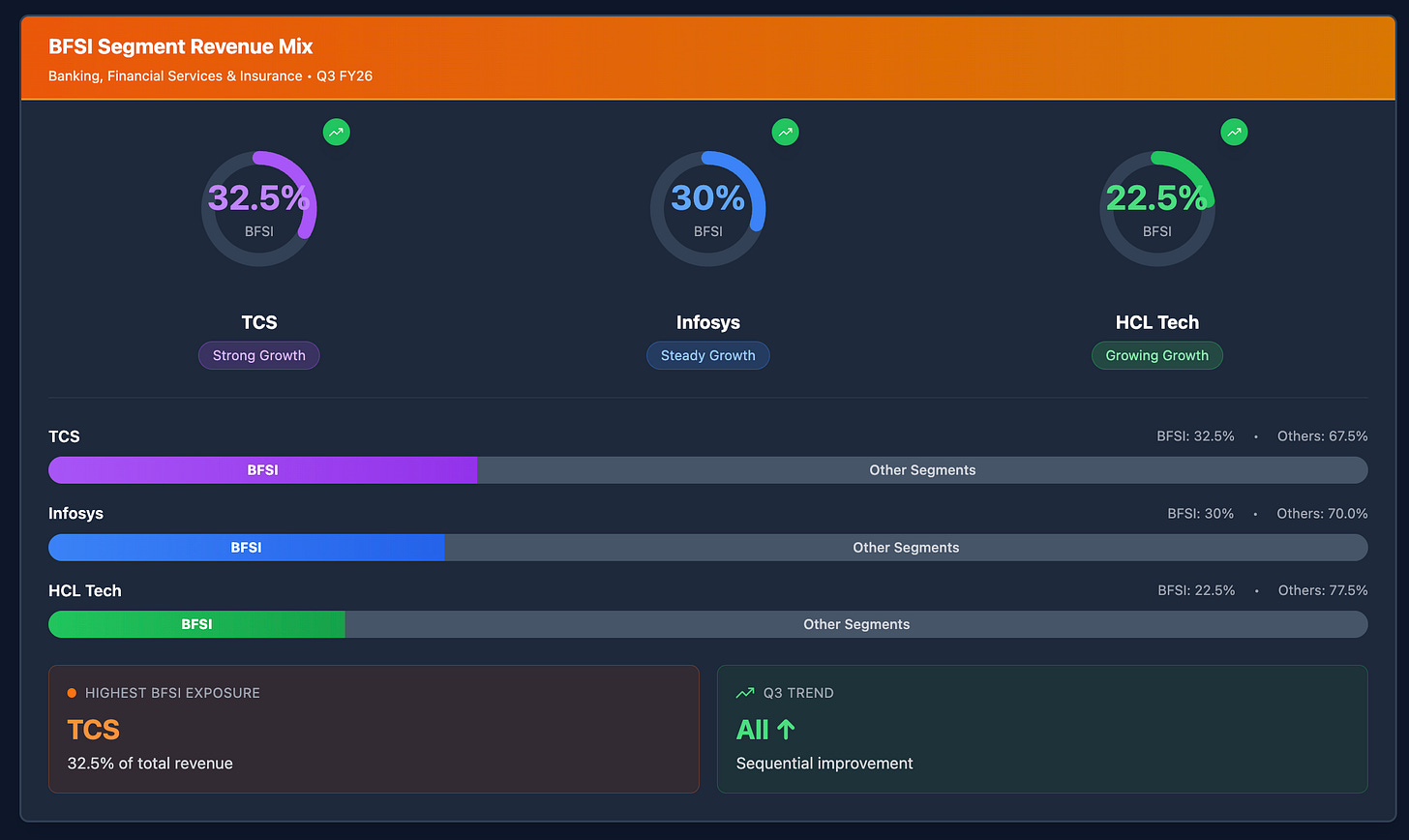

All three companies are singing the same tune: “BFSI is back.”

TCS: BFSI TCV at $3.8B (up $600M QoQ and YoY)

Infosys: “Good traction in large deals and discretionary projects”

HCLTech: BFSI grew 8.1% YoY

Chart 6: BFSI Revenue Contribution

Why BFSI matters: It’s the highest-margin vertical, the largest AI adopter, and the discretionary spending gatekeeper. When BFSI spends, the whole IT sector benefits.

The catalysts:

Digital transformation acceleration

Regulatory compliance (AI governance)

Modernization of core banking platforms

AI deployment in fraud detection, customer service, and risk management

The Auto Anchor

Remember our earlier auto sector analysis? The weakness is showing up in IT services too.

TCS: “Automotive side continuing to be weak”

Infosys: “Auto sector remains challenged”

HCLTech: “Mobility segment seeing stability but early to call secular growth”

Aero & Defense (part of Manufacturing) is strong. Industrial manufacturing (supplying AI data center equipment) is growing. It’s specifically automotive that’s dragging.

The ROE Story: Capital Efficiency Matters

Remember our lemonade stand lesson? Let’s apply it to IT companies.

Chart 7: Return on Equity Comparison

TCS: ~45% (Services ROIC)

Infosys: 32.8% (ROE)

HCLTech: 39.4% (ROIC, up 277 bps YoY)

Industry Average: ~25-30%All three are capital-efficient machines. They generate high returns on the money you invest.

But look at the trajectory:

HCLTech: +277 bps YoY improvement (getting more efficient)

TCS: Stable ~45% (consistently excellent)

Infosys: 32.8% (lower but stable)

If you invest ₹100 in equity:

TCS generates ₹45 in annual return

HCLTech generates ₹39.4 (improving)

Infosys generates ₹32.8

The Opportunity Map: Where Alpha Hides

Now for the exciting part: where can you make money?

Opportunity #1: The AI Infrastructure Wave

Best positioned: HCLTech, TCS

The $1 trillion AI infrastructure buildout is just starting. HCLTech’s “Day-1” services (AI factories, custom silicon) and TCS’s data center play are capturing this.

The thesis: Before enterprises deploy AI, they need infrastructure. This is multi-year, high-margin, capex-linked revenue.

The catalyst: Hyperscaler capex announcements, enterprise AI budgets for 2026-27.

Opportunity #2: Legacy Modernization at Scale

Best positioned: Infosys, TCS

There are billions of lines of legacy code sitting in enterprises. AI makes modernization economically viable for the first time.

Infosys + Cognition (Devin agent): Already winning deals

TCS: Building Human+AI autonomy frameworks

The thesis: This is a $50B+ TAM that was previously unaddressable. AI unlocks it.

Opportunity #3: BFSI Consolidation Wins

Best positioned: All three, but TCS leading

Banks are consolidating vendors, and these three are winning share.

TCS: Two consecutive mega deals in BFSI

Infosys: Strong deal momentum in Financial Services

HCLTech: 8.1% YoY growth in BFSI

The thesis: Vendor consolidation = larger deal sizes = annuity revenue streams = margin stability.

The Missing Piece: When to Enter

You now have the what:

✅ Growth divergence (HCLTech leading)

✅ Margin dynamics (TCS defending, HCLTech improving, Infosys stable)

✅ AI revenue traction (TCS = scale, Infosys = partnerships, HCLTech = differentiation)

✅ Risk and opportunity map (know where landmines and alpha hide)

✅ Valuation context (price vs. quality vs. growth)

But you still don’t have the WHEN.

Here’s the thing: You could pick the perfect IT stock - strong AI revenue, expanding margins, great ROE - and still lose money if you enter at the wrong time.

The market doesn’t reward knowledge. It rewards timing.

The best stock at the wrong price is still the wrong decision.

Know someone holding IT stocks without a timing strategy? Forward this to them. They’ll thank you later.

One final thought:

The AI transition in IT services is real. The revenue is starting to show. The deals are being signed.

That doesn't mean you stay out. It means you stay selective.

And most importantly: Have a timing system.

In the next piece, I will talk about where do I enter and the timing metrics that I use.

Thank you for your time and attention.

Yours,

Saksham Ahuja

WealthLab